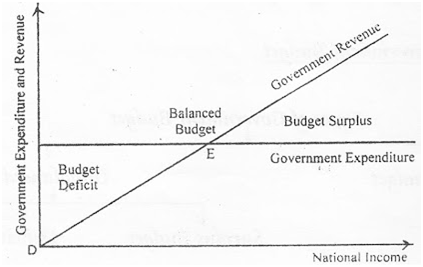

The other strategy entails making sure that the budget is followed up to the last dot. One of the strategies put in place is the forecasting, whereby the business enterprises prepare forecast budgets prior to the actual budgets. This is because a budget forms a critical point during decision making for the business enterprise. The strategy put in place should be able to ensure that the budget balances properly and that there is no deficit or surplus. taking into consideration this fact, it has to be strategically planned and managed in order to achieve its objectives. The process of budgeting is of a great concern, as well as other business processes. Taxes are paid to the government, and donations from aid bodies present another way through which governments get finances. The most common ones include trust funds in which the government disposes some of its current assets that are not in use hence creating a trust fund for them.Īnother method of financing the government is providing the user fees paid by legal entities and individuals to get the authority of running specific services. The government has different ways of financing its budget.

Reserves entail the money invested into the company in the form of shares by external parties (shareholders) to the businesses. Second, they can get funds from reserves which are also known as the shareholders equity. In this case, the source of funding will be the business itself. First, they can get funds from the profits generated by the business. Types of fundsīusinesses have different sources of getting their funds. Another type is a government budget, it is a budget according to which government plans the resources of the nation. In that case, there are sales budgets, revenue budgets, production budgets, expenditure budgets, and cash budgets. Therefore, the first type of budgeting is a personal budget, which presents a plan on how the funds of the individual will be used within a certain period (Stringfellow 1).īusiness budgeting is diversified to plan for specific funds that are allocated to different sectors of the business (Stringfellow 1). For instance, personal budgets are different from business budgets. Types of budgetingīudgets normally differ in a number of ways. This depends on a number of reasons such as resources, policies, and business lifespan among other reasons. A budget cycle can also refer to the time span between one budget and the next one.īudget cycles normally differ from person to person and organization to organization. In other words, it is a time taken to exhaust the budgeted resources of a budget. A budget cycle can be defined as a duration in which a budget will last.

0 kommentar(er)

0 kommentar(er)